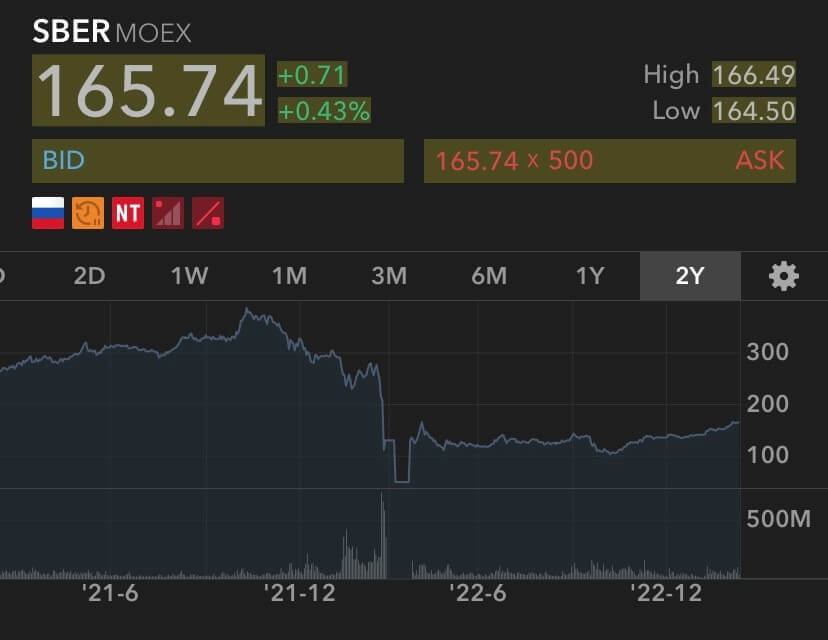

The 2nd of March, 2022 the share price of Sberbank on the London Stock Exchange went on a wild rollercoaster ride straight into the abyss. Not too long before, the price was trading around 21 USD a share and now a low of 0.01 USD a share was reached. On that day alone the stock plummeted with more than 92%. Shortly after, the trading was suspended indefinitely.

A share price of 0.01 USD per share would mean that the company would be close to being worthless or that it would face bankruptcy very soon. Albeit, that was not the case here and thus a rare opportunity presented itself…

Sberbank is one of the biggest financial institutions in Russia and has its primary listing on the Moscow Stock Exchange ('MOEX'). It is also listed on the London Stock Exchange (and the New York Stock Exchange) to allow non-Russian market participants to more easily gain access to its shares. These shares are interchangeable and their prices should follow each other, i.e., a trader who bought the shares on the London Stock Exchange can request their broker to convert them to an equivalent number of shares trading on the MOEX. In normal situations traders won't engage in such conversions since there is no financial gain to win, or in other words: arbitrage is not possible here since the prices are derived from each other.

But these were no normal situations: on the 2nd of March, 2022 the MOEX had suspended its stock trading activities already for more than a week and it was uncertain when Russia's central bank would announce a reopening of its stock market.

Buying the shares on the secondary listing in London obviously entailed several risks, however, the opportunity to buy them for 1 cent presented an extreme asymmetric playoff and one of the craziest arbitrages I've ever witnessed. Indeed, I mention "witnessed" since I decided not to partake in this event. The old cliché is you buy when there's blood in the streets, but not literally. The screenshot below shows the price action of that day and shows market participants scooping up large amounts of shares around the 1 cent mark.

These buyers most likely did one of two things next: (1) either they sold at a profit (or loss) later that day (pure day-trading gambling), or (2) they performed an arbitrage trade later on in which they converted their shares to the ones trading on the MOEX (with a 1 to 4 ratio).

With the current share price of Sberbank, as depicted below, around 11 USD, the return on investment would thus have been an astronomical 1000x. The problem however that day was the low volumes on offer which capped the profit potential. I estimate that around 150kUSD was traded that day, while in the days before this was between 200mUSD and 350mUSD, with share prices between 1,5USD and 4,5USD. Nevertheless, even if you would have bought these shares in the days before, the gains still would have been substantial.

What I thought was especially interesting was seeing how brokers interpreted the imposed sanctions on these stocks in very diverging ways and demonstrating again the need to also diversify your assets across different brokerages. These were unique situations and hopefully we won't experience them anymore, but still it was valuable to learn which brokers had the best interest for their clients and which fell short in doing this.

The new year is well underway now, sentiment appears to be have shifted for the moment, but an even more sticky inflation (remember our central bankers shouting that inflation was transitory all year long in 2021, good times) and higher for longer interest rates pose some of the risks going forward (together with UFO's apparently popping up all over the globe). Sit back, keep your eyes open for opportunities, and enjoy the ride!